Aviator – новое поколение азартных игр

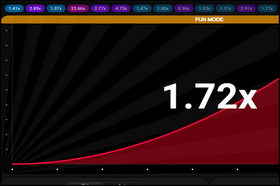

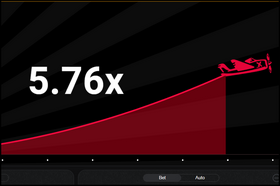

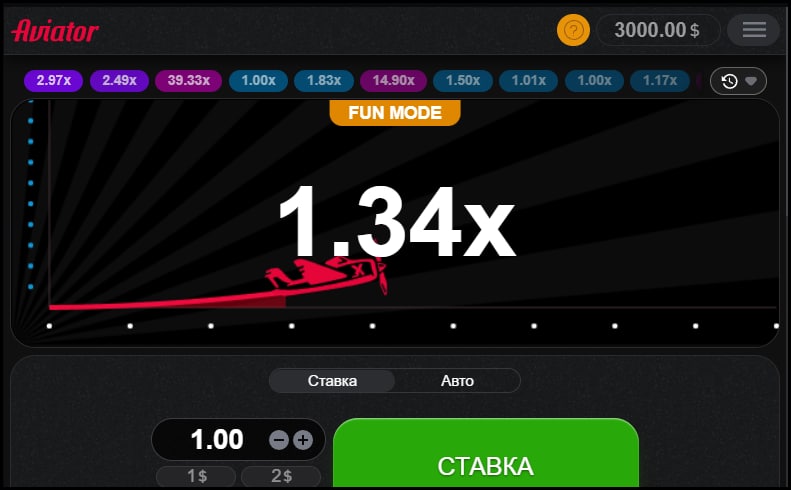

Aviator – игра на реальные деньги для ставок. Впервые Авиатор Spribe появился на сайтах онлайн-казино только в 2020 году и уже за два года завоевал тысячи поклонников по всему миру. Краш-игра предусматривает максимально простые правила – игроку достаточно сделать ставку и успеть ее забрать до момента взлета самолета. Рекордная продолжительность одной сессии составила более четырех минут и принесла игроку выплату, в 1224320 раз превышающую размер ставки.

Где играть в самолетик – лучшие условия для любителей ставок

Авиатор игра доступна в известных онлайн-казино с международной лицензией:

Лучшие казино для игры в Авиатор

Среди онлайн-казино игроки смогут выбрать компании с выгодными условиями для ставок, быстрыми выплатами и щедрыми бонусами для новичков. Сама краш-игра не предусматривает возможности доступа к внутренним настройкам со стороны администрации игорных заведений. Поэтому правила, механика игры и уровень вероятной отдачи остаются неизменными. При выборе казино следует ориентироваться на его репутацию и бонусные предложения.

Доступные правила

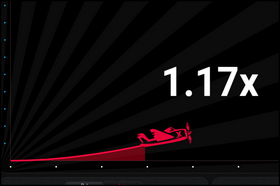

Играть в Авиатор онлайн предельно просто. Необходимо сделать ставку и дождаться начала раунда. Как только самолет пойдет на взлетную полосу, размер потенциального выигрыша будет постоянно расти. Забрать выплату можно в любой момент до тех пор, пока самолет не улетит из игрового поля. Aviator Online потребует от игроков выдержки и готовности идти на риск.

Быстрые ставки

Преимущество Aviator – высокая динамика игры. Средняя продолжительность раунда не превышает 10 секунд. За счет этого игроки могут в кратчайшие сроки значительно приумножить игровой банк. Можно даже настроить автоматическую игру и наблюдать за стабильным ростом баланса.

Легкие выплаты

Все выигрыши после каждого раунда моментально зачисляются на лицевой счет в online casino. Игрок может вывести средства с игрового баланса в любой момент любым доступным способом: на банковскую карту, электронный кошелек или даже на криптовалютные счета.

Мобильный Авиатор — как играть на телефоне

Любой желающий может играть в мобильный Авиатор вне зависимости от выбранного игорного заведения. Разработчики Spribe провели отличную работу, оптимизировав крэш-игру под всевозможные платформы, операционные системы и устройства.

Играть в мобильный авиатор можно двумя способами:

- Через браузер на смартфоне или планшете. Перейдя на азартный сайт с мобильного браузера и открыв Aviator, игра запустится и будет готова к использованию.

- Через приложение. Если у игорного заведения есть приложение, можно запустить Aviator в приложении. Так можно скачать Авиатор и иметь к нему доступ вне зависимости от блокировки азартного сайта в стране игрока.

Чтобы понять, где играть в Авиатор через приложение, стоит посетить сайты Pin Up, 1xBet, 1win, Мостбет, Play Fortuna. Останется лишь скачать и установить бесплатное приложение выбранного онлайн-казино, и играть там в Aviator.

Промокоды Авиатор — как получить бонусы для игры на реальные деньги

В некоторых интернет-казино выдаются бесплатные раунды в Avitor с определенной суммой ставки. Узнать о таких акциях и получить промокоды Авиатор удобнее всего, просматривая аккаунты/группы/каналы/сообщества игорных заведений в социальных сетях и мессенджерах.

Также можно играть в популярную крэш-игру на бонусные деньги, полученные с различных акций. Возможность отыгрыша в Авиаторе зависит от правил каждого азартного сайта.

Взлом Авиатор — алгоритм крэш-игры

В сети можно наткнуться на множество предложений о получении алгоритмов в Aviator, причем даже бесплатно. Якобы казино или сама игра взламываются, и гарантируются высокие выигрыши по схемам. Как бы ни хотелось в такое верить, но никаких алгоритмов, схем и взломов не существует, особенно по отношению к известной крэш-игре. Все, кто говорит о подобных небылицах, являются мошенниками.

Провайдер Spribe использует в Aviator технологию Provably Fair, которая сводит даже гипотетический шанс взлома на нет. По данной криптографической технологии расчет каждого раунда проходит у разработчика, у первого, второго и третьего игрока. Получается, что результат полета кукурузника каждый раз определяется на разных серверах, ибо очередность игроков не повторяется.

Непосредственно результат игры определяет генератор случайных чисел. Он полностью хаотичен и непредсказуем.

Демо режим при игре в Авиатор

Единственный рабочий способ слегка увеличить шанс на выигрыш в Авиаторе — это игра в демо-режиме. В нем игровой процесс проходит на виртуальные деньги, которые ничего не стоят и автоматически пополняются.

Играя в демонстрационном режиме, можно не торопясь изучить игру. В частности, следующие особенности и показатели:

- Понять интерфейс.

- Освоить правила.

- Научиться быстро снимать деньги при необходимости.

- Прочувствовать игровой процесс на себе.

- Привыкнуть к игре.

- Протестировать стратегии.

По итогу игры в демо-режиме будет понятно, нравится Авиатор или нет. Если ответ положительный, можно переходить к игре на реальные деньги, пополнив счет на выбранном азартном сайте.

Что игроки думают об игре Авиатор — отзывы реальных людей

Aviator любим массой гемблеров благодаря простым правилам и игровым механикам. В отзывах игроки пишут, что времяпровождение в крэш-игре проходит увлекательно и атмосферно, с приятными азартными ощущениями.

Львиная доля отзывов положительные. Помимо очевидных плюсов игры, по типу честного расчета ставок, непредсказуемости результатов и возможности выиграть сумму с огромным множителем, упоминаются и другие преимущества:

- Качественная графика вкупе с приятным стилем и звуками.

- Расслабляющая атмосфера.

- Возможность делать две ставки на один раунд.

- Функция автоматического вывода.

- Удобный и понятный интерфейс.

Отрицательных отзывов мало, и они не претендуют на объективность. Чаще всего негативные мнения представляют собой жалобы игроков, которые увлеклись и слили банк в Авиаторе.

Лучшие бонусы Авиатор

Для наиболее комфортной игры пользователи могут воспользоваться акциями и бонусами от интернет-казино. Это могут быть депозитные бонусы, которые увеличивают сумму пополнения игрового баланса или кэшбек. При помощи кэшбека можно вернуть значительную часть проигранных ставок.

Новые онлайн-казино

С каждым днем все больше игорных заведений предлагает своим клиентам испытать удачу. Новые казино стараются привлечь широкую аудиторию за счет самых выгодных бонусных программ.

Высокие лимиты для ставок

Ставки в Aviator имеют широкие лимиты. Во многих казино игроки могут поставить от 1 рубля. Максимальная сумма возможной ставки часто превышает тысячи рублей. Вариативные лимиты создают оптимальные условия игры как для новичков, так и для опытных любителей ставок. В сочетании с простыми правилами Авиатор Онлайн стал одной из наиболее востребованных в онлайн-казино и игровых букмекерских сервисах.

Правила и стратегии – Как выиграть в Aviator

На нашем сайте можно найти подробные правила игры для новичков с описанием наиболее популярных игровых стратегий. Стратегии позволяют избежать проигрышей и минимизировать риски, с их помощью пользователям удается получать стабильную прибыль на дистанции. Aviator – новое поколение азартных игр, которое придется по душе любителям ставок.

* Азартная игра. Строго 18+